Bloomingdale’s shows strong multichannel commerce efforts: L2 Think Tank

Bloomingdale’s, Montblanc and Nordstrom have shown strong multichannel commerce efforts through their email campaigns that drive consumers to purchase both online and in-stores, according to the latest study from L2 Think Tank.

The “Intelligence Report: Multichannel Retail” found that many luxury brands are not leveraging digital and mobile technologies to drive consumers into their retail locations. Also, for those luxury brands that do use ecommerce, many outsource this commerce to a third-party retailer instead of hosting the technology on their own Web site.

“L2 consistently finds that email marketing is one of the biggest drivers of ecommerce and the savviest brands in our multichannel retail study are beginning to use email to drive in-store sales as well,” said Claude de Jocas, research associate at L2 Think Tank, New York.

“Overwhelming, luxury retailers are not taking advantage of the opportunity to lure shoppers to their boutiques via in-store exclusive sales, in-store product pick-up, or the promotion of events or services at retail locations,” she said.

The Intelligence Report: Multichannel Retail 2013 measured 79 retailers across 250 data points on four categories, which are Web site, search, mobile and email. Emails included in the study were sent by all 79 brands through Q4 2012 – Q1 2013.

Power of email

Luxury brands seem to be more concerned with driving consumers to ecommerce via email instead of in-store.

Prada, Christian Dior and Dolce & Gabbana did not send one email promoting store locations in the last two quarters of 2012, compared to Bloomingdale’s that mentioned in-store service in 100 percent of its emails.

Montblanc mentioned in-store services in 76 percent of its emails and Nordstrom mentioned this in 28 percent of emails.

“Between Q4 2012 and Q1 2013, Dior, Dolce & Gabbana and Prada all did not send a single email with a drive-to-store component,” Ms. de Jocas said. “Chanel and Donna Karen made limited efforts, pushing to brick-and-mortar locations in just 6% of marketing emails.”

In addition, Chanel, Tiffany & Co. and Gucci promoted free shipping, which pushed their focus more on ecommerce.

None of the brands in the study mentioned an in-store exclusive sale, in-store pickup or an event or service offer at a freestanding retail store via email, although Barneys New York and Bergdorf Goodman promoted events in 5 percent and 7 percent of emails, respectively.

However, Tiffany, Cartier, Prada and Ermenegildo Zegna linked to a store locator through their emails, so consumers had to click through the email to access it.

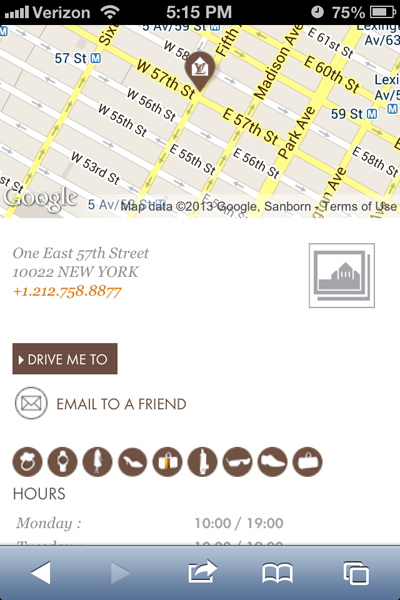

Also, Louis Vuitton allows store locations to be shared through email via its mobile-optimized site. The email information includes store contact information and a link to Google Maps.

“Louis Vuitton is one of just three brands in the study that allows consumers on a mobile device to share a specific store location via email,” Ms. de Jocas said.

Heading elsewhere

Many luxury brands are still resistant to providing ecommerce.

“Luxury brands have been hesitant to adopt ecommerce, with brands such as Dior and Salvatore Ferragamo not launching online stores until 2010 and 2011, respectively,” Ms. de Jocas said.

“Given this wait-and-see attitude, we were surprised that more luxury brands didn’t use their site to push toward what is arguably their greatest sales asset – their stores,” she said.

In addition, the report found that many luxury brands link to other third-party retailers for their ecommerce.

“We see a higher percentage of luxury brands outsourcing their ecommerce business to third-party platforms, such as the Kering partnership with Yoox, and Labelux partnership with eCommera,” Ms. de Jocas said.

“This often results in the site being a siloed channel that does not drive to brick-and-mortar stores – a huge miss given the investments they’ve made in those environments,” she said.

Final take

Erin Shea, editorial assistant on Luxury Daily, New York